We all often think about our money habits; in fact, money is what everyone really thinks about. No doubt there! Everything you basically need, from the food you eat to the shelter above your head, to your education became a reality after money exchanged hands. We want it all, the hottest phone, the cosiest home, nights at the movies, date nights with hot guys/chiqs… And because we want it all, we find ourselves in the same boat with each other: Spending more than we earn and failing to have a budget.

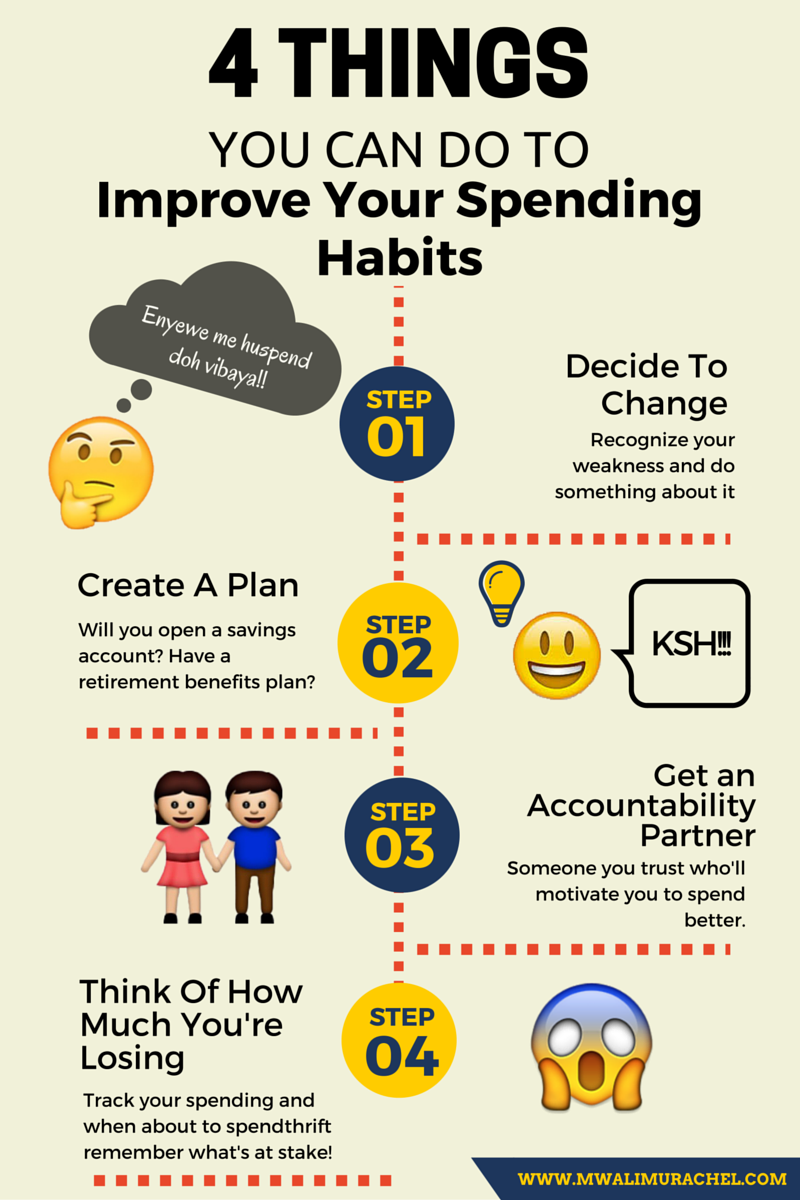

Here are a couple of things you can keep in mind to create better money habits.

Decide to change

All new good habits start with a confession – admitting you have a problem – and choosing to do something about it. If you spend all your cash on partying or find yourself spending more than you can afford to spend, realize that your current habits do not add value in your life. Neither does spending 5k on a couple of dresses when you know you’ll not have bus fare for a couple of days.

Actually create a plan

Otherwise you’ll never follow through! When you have bad money habits, it helps to reduce your financial decisions – Only plan for what you actually need.

You could open a savings account or start a retirement benefits plan. You’re never too young to start planning for your retirement by the way! Imagine how much money you’d have by the time you’ll get there! I actually used an online calculator from one of our local insurance companies – note that I’m now 25 – and if I saved KES 1000 every month until I retire at 65, I would have 32,470,979!!!!

You could also try using a prepaid debit card (which is NOT a credit card). This could help limit spendthrift habits – because you’ll set the amount you need, say, for shopping, and once the money you set is gone, you’re basically done spending.

Have a friend help you out

I don’t mean help with regards to lending you cash or keeping your cash for you. I mean, how many of us have friends we can actually trust with our money? (Hmmm… That’s a question for another day…) Anyway, you get Le Bae or a close friend – basically, someone you trust – to be your accountability partner. He or she should be able to remind you what your saving for or stop you from spending badly.

Think of the money you’re losing

If finding a friend to help out proves to be a challenge, you can do this. No one likes to lose cash. If you constantly remind yourself of how much cash you’re losing for unworthy causes, it’s bound to motivate you to want to do better. The first thing you need to do is track your spending – every single shilling counts.

All in all, when you have better spending habits, you’re bound to create more wealth for yourself. Don’t wait to get a “well-paying” job… It starts with the little you have. Besides, if you can’t be accountable for the little, how will you manage the millions?